What’s Happened?

To even the most casual observer it has been difficult to ignore the business news over the last several months. Gold, Platinum, and Silver, the stock market riding high one week after another. Index’s breaking new ground, and higher levels reached almost daily.

If we’ve spoken in person over the last 3 years, or you read our piece on ‘What’s behind the rise of Gold?’ (link), you will already be aware that the precious metal rally is nothing mysterious. The sharp rise in gold’s value is directly correlated to the change in risk-free asset rules for banks in the Basel III regulations, and the loss of faith in fiat currencies and government debt.

The change in Basel III regulation created pressure on central banks to move away from unallocated “paper” gold bullion toward allocated “physically” backed structures, which were all part of the Basel III net stable funding ratio (NSFR). Originating in 2014, this was slowly phased in across jurisdictions, reaching Switzerland and the EU in 2021, and the UK in 2022; the UK having such a big impact because London is the dominant centre for precious metals clearing and trading.

Simultaneously, successive U.S. Presidents from the left and right pushed for increased money supply, adding to the national debt with every term, culminating in a $32 national trillion debt by the spring of 2024. This can be seen as a watershed moment; where the average investor became aware, and the gold price began to sky-rocket.

As we at IWP noted repeatedly to investors; it’s not so much that the gold price has gone up, as the value of fiat currencies has gone down. Swiss property prices, for example, have actually decreased if valued in gold. More on that here: IWP/Swiss-property-valued-in-gold

With the mass adoption of LLM’s (namely ChatGPT) we have equally seen an incredible run for semiconductors and the AI-adjacent tech sector.

Sell-off

Fast-forward to today, and we've just seen Gold and Silver - as well as other metals - take a massive dive. However, despite what you read in the press about the cause being Trump – or his pick for a new Fed chair – in reality, this was purely a mechanical sell-off.

Commodity indexes have a mandate that dictates a specific percentage allocation of each asset. When one of those assets becomes significantly larger or smaller, rebalancing is necessary. Fund managers didn’t speculate that the price of gold was too high; instead, computers running passive ETFs mechanically sold over-weight positions (Gold, Silver) whilst allocating to under-weight positions (Oil). This happens every January.

The tandem pressures of the Basel III regulation changes and loss of faith in bonds, plus the over-exuberance in AI investment (and current fear of an AI-bubble), have resulted in today’s unusual scenario where we see both stock and bond markets negatively performing at the same time.

What happens next?

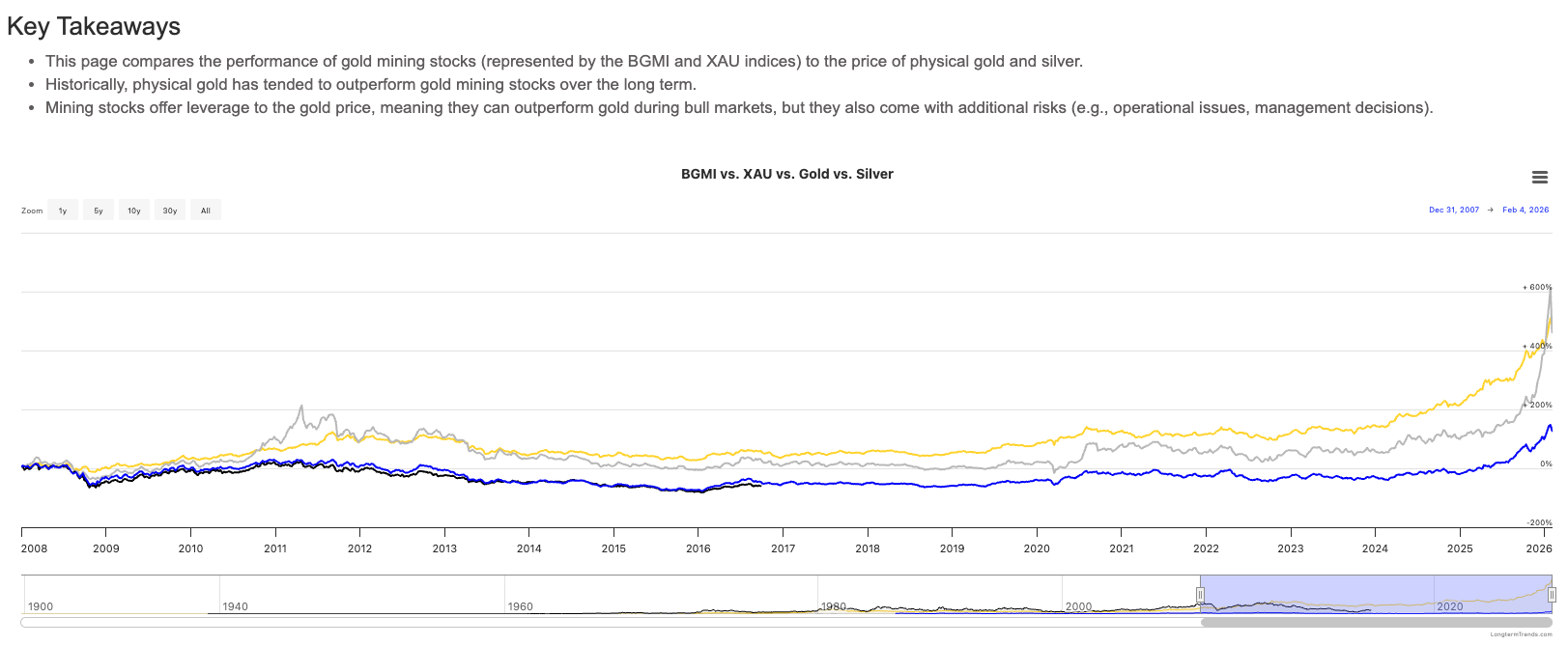

Gold, silver, and industrial metals miners have broadly underperformed the metals they extract for over a decade. If you think that metals miners can spend 16 years lagging, finally start catching up mid-2025, rally for six months, and then suddenly roll into another bear market, you need to take a moment and think logically.

Source: longtermtrends.com

Equally, for the stock markets, look at the macro-economic picture.

- Interest rates – after many years climbing to hold back ‘transitory’ inflation – are creeping lower.

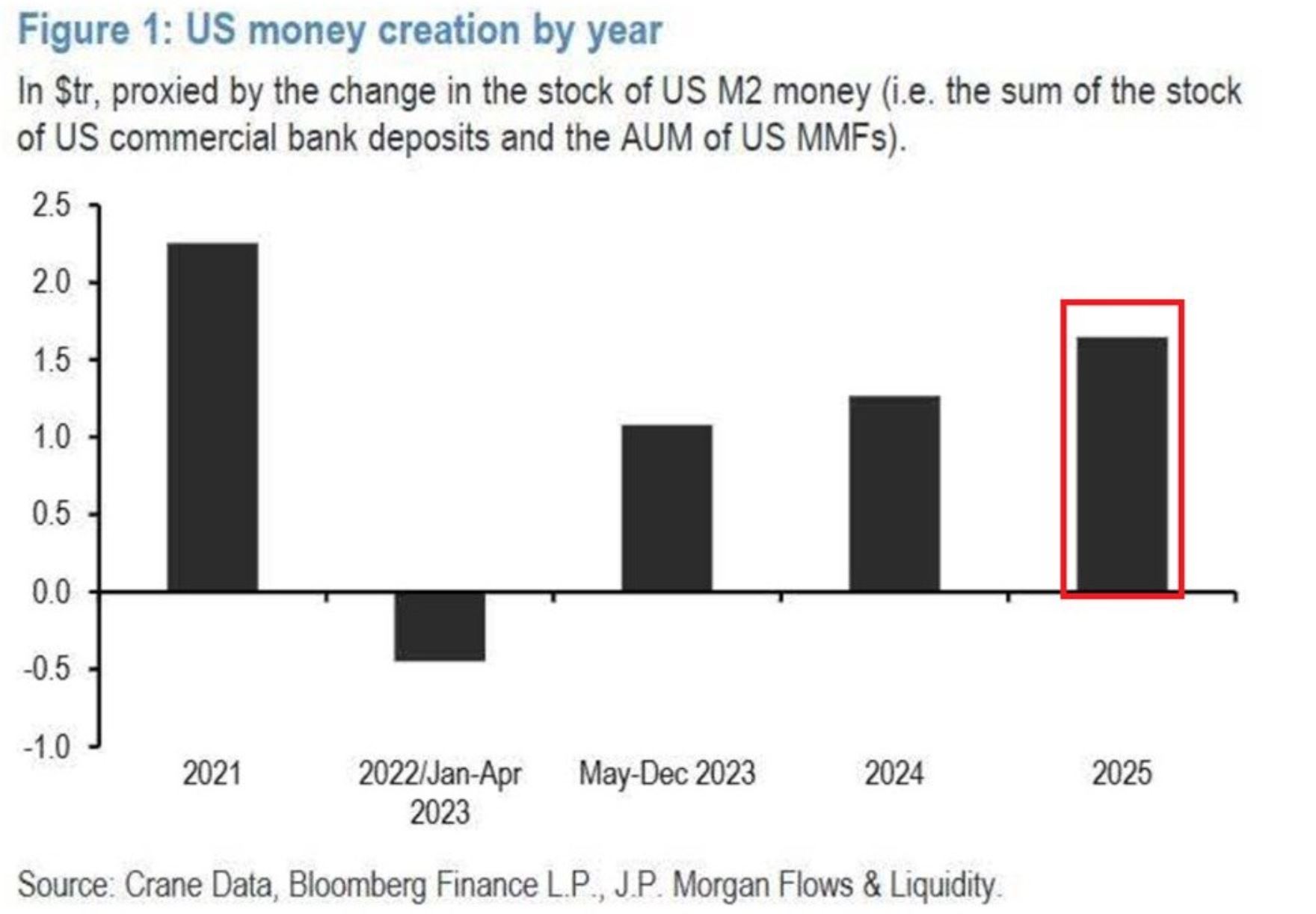

- Following quantitative tightening (decreasing money supply) to pare back inflation, US M2 money supply jumped +$1.65 trillion in 2025 – the largest annual increase since 2021.

- The result: a higher supply of cheap money.

- The secondary result: inflation on the horizon.

What we’re seeing now is a healthy pullback. The excess gets wiped out, the late money gets punished, and late-stage investors bought the hype get flushed out. Long-term investors who buy and hold are not concerned, because they have no intention of selling while quality assets are cheaper. If anything, they want to buy more.

For those of you wanting to be ‘safe’ in your model ‘cautious’ fund from your bank – watch your money disappear as bonds lose value in an inflationary environment, just like in 2021 and 2022.

For those of you invested – stay the course.

And for those of you sitting on overweight cash – happy shopping! It all just got a lot cheaper.

Although time in the market beats timing of the market, it pays to take advantage when there is a significant pullback and fundamentals remain strong.

Disclosure:

This article has not been written to give advice, and purely expresses our own opinions. We are not receiving any compensation for it, and we are not responsible or liable in our capacity as an independent financial adviser for any action taken by readers based on these opinions. For personalised advice based on these issues, please seek advice from a regulated, independent expert.